Offsetting your tax bill by contributing to a pension

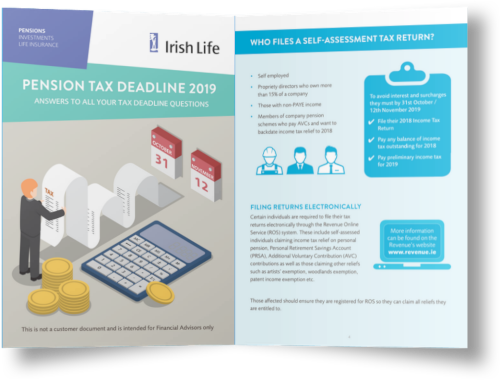

The deadline for those who both pay and file their tax returns through the Revenue Online Service (ROS) is Tuesday 12th November.

The deadline for those who both pay and file their tax returns through the Revenue Online Service (ROS) is Tuesday 12th November.

Individuals who both pay and file their tax returns through the Revenue On-line Service (ROS) have until Tuesday 12th November 2019 to pay a pension contribution and elect to backdate the income tax relief against the 2018 tax year. Those who do not qualify for the ROS extension must do this by 31st October 2019.

There is no option to defer. If they do not take this opportunity, they will not get another chance to reduce their 2018 income tax liability.

Download our Income Tax Examples presentation showing examples with & without pension contributions

Download PresentationTo help you calculate how much your clients can contribute for tax relief purposes for this year, or to target the Revenue Maximum allowable, why not try out our calculators?

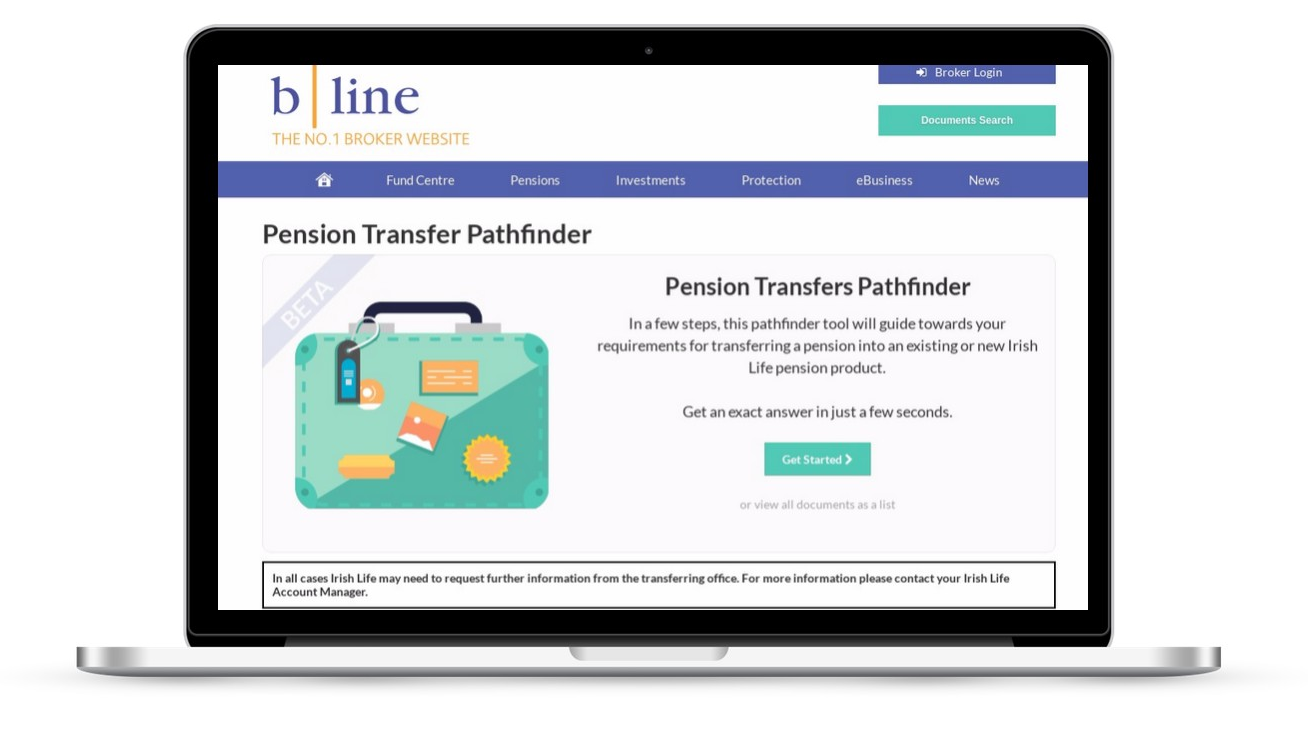

In a few steps, our new pathfinder tool will help guide you towards the requirements for transferring a pension into a new or existing Irish Life Complete Solutions or other Retail pension product. The tool provides support on all of the different types of pension transfers that are allowed and is all part of our journey to make things easier for brokers.

We hope you find it useful and we look back to your feedback

Open the Pension Transfer Pathfinder