3 Steps to Securing Your Clients Legacy

Helping your clients protect their assets from inheritance Tax when they pass them on to their beneficiaries is a vital component of the Sales Advice process. It is an area where you as the Adviser can provide the solution through setting up a Life Assurance plan under Section 72.

This digital checklist can be completed by your client to help you gather all the relevant information you need from them.

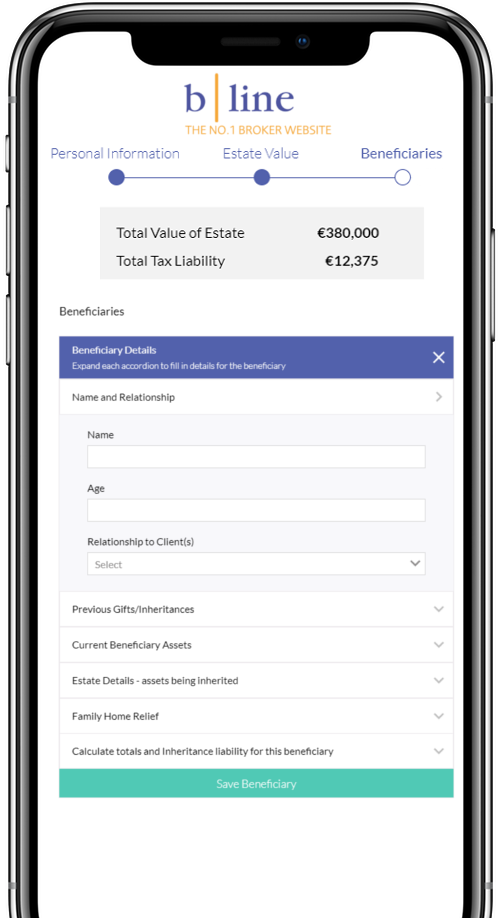

get_app DownloadOur simple to use Estate Planning Pathfinder will calculate the CAT liability for each of your clients beneficiaries

launch Open Estate Planning PathfinderThe Estate Planning Pathfinder will create a report for your clients based on the information they have provided. The report summarises the information, provides the relevant Capital Acquisitions Tax (CAT) liabilities for each of the beneficiaries in the estate and sets out some options that are available to them.

Take some time to get a better understanding of how easy the process is with our walk-through video below

A range of client flyers to support you in reaching your target market.

A range of flyers to support you in advising your clients on their estate planning needs

Our complete library of estate planning supports